Simplifying Tax Complexity

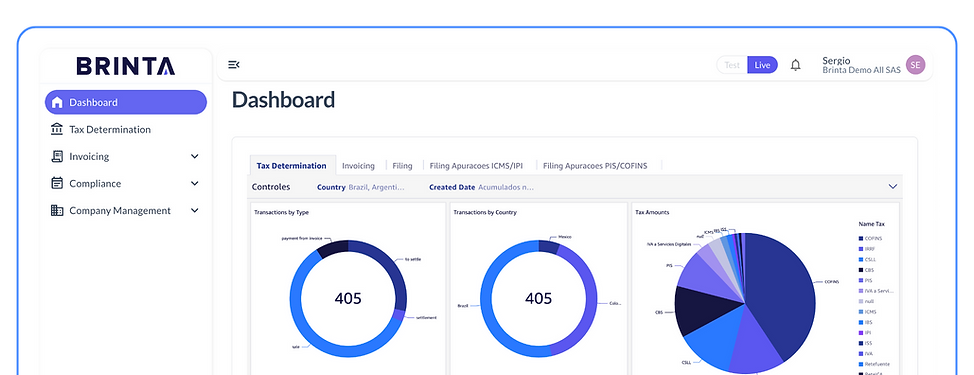

Brinta is an AI-powered platform that automates tax compliance across Latin America, integrating tax determination, invoicing and compliance filings into a single interface.

Talk to our team

Empowering the world's best tax teams

The first AI-native tax automation platform built for Latin America

Latin America sees an average of 50 tax updates every day, making it nearly impossible to keep up with the constantly evolving regulations without an automated solution. That's where Brinta's tax automation platform comes in. Our mission is to offer a fast and effortless way to achieve tax compliance.

.png)

Tax Determination

Automates tax calculations for sales, purchases and logistics across Latin America.

.png)

Invoicing

Centralizes the issuance, receipt and reconciliation of tax documents.

.png)

Compliance

Automates the calculation, reconciliation and submission of tax obligations to regulatory tax authorities.

A solution for every business in any LATAM country

Fintechs

Brinta empowers fintechs with a robust platform that allows business to scale in Latin America throughout multiple use cases:

-

Real-time tax calculation for transactional volumes across all regimes (VAT, withholding, perceptions, ISS, ICA and similar).

-

Automatic issuance of withholding certificates across LATAM.

-

Processing and filing of fintech-specific obligations such a DESIF, e-Financeiras, DIMP, SICORE, SIRTAC, ARCIBA and equivalents.

-

Fiscal KYC for clients, merchants and suppliers with Tax ID validation and status checks.

-

Multi-country e-invoicing at the transaction level with support for split fees and complex pricing models.

Why do the most innovative tax teams choose Brinta?

Regional (LATAM First)

Built for the fiscal complexity and diversity of Latin America.

Technological

Cloud-native, API first and AI powered tax inteligence.

Integrated and multi-language

Eliminates silos across processes and countries and ensures everyone can navigate Brinta in their own language.

Reliable and secure

Ensure accuracy, visibility and continuous compliance while ensuring top-industry data security standards.

Watch our latest webinar

Discover how Brinta centralizes tax automation across Latin America, eliminating fragmentation and giving your team the clarity, speed and control needed to keep operations running smoothly.

Resource center

A centralized Resources Library with blog posts, webinars, videos, guides and technical documents that simplify complex tax topics and showcase practical workflows across LATAM.

.png)

Coverage

Get Brinta's tax insights for free

Got questions?

Couldn't find what you need? Ask our team.