How to Change the Language on Brinta’s Tax Automation Platform: A Step-by-Step Guide

- Sergio Morganti

- Nov 7, 2024

- 2 min read

Introduction to Brinta: The Leading Tax Automation Platform for Latin America

Brinta is a powerful tax automation platform designed to streamline tax compliance, reporting, and filing processes for companies operating across Latin America. With its advanced automation capabilities, Brinta enables finance and tax professionals to manage complex tax requirements in multiple jurisdictions, reducing manual work and the risk of errors. An additional feature of the platform is its multilingual interface, allowing users to select their preferred language for a more intuitive experience. This step-by-step guide will walk you through how to change the language settings on Brinta, ensuring the platform is accessible to everyone on your team.

Step 1: Access Account Settings on the Tax Automation Platform

Begin by logging into your Brinta account.

In the top navigation bar, locate the profile icon in the upper-right corner, next to your username (“Hi, [Your Name]”).

Click on the profile icon to open a dropdown menu, then select “User profile”. This will take you to your user profile settings, where you can update various personal settings.

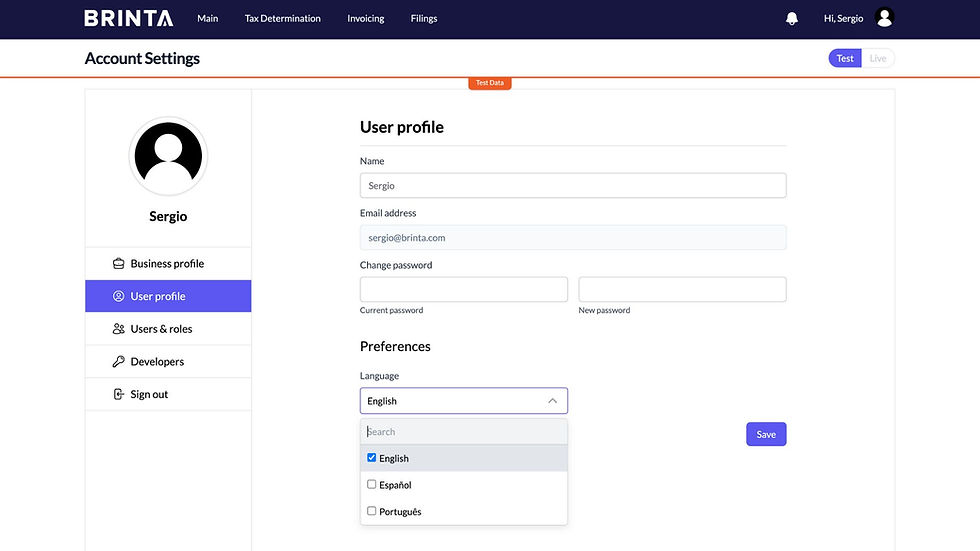

Step 2: Locate the Language Preferences Section

Once on the profile settings page, you will see fields with your basic information, such as name, email address, and password options. Scroll down until you reach the “Preferences” section, which includes the language settings for your account.

Step 3: Change the Language on Brinta’s Tax Automation Platform

1. In the “Preferences” section, look for the “Language” dropdown menu.

2. Click the dropdown to reveal the language options. Choose your preferred language from the available options (English, Español, or Português).

3. After selecting your language, click the “Save” button to apply your changes. This will update the language across the Brinta platform, allowing you to interact with the interface in the chosen language.

Step 4: Confirm the Language Change on Your Dashboard

Once saved, the platform will refresh, applying the new language setting across all sections of the interface. This feature makes Brinta an ideal choice for teams that operate in different languages, as it enhances usability and facilitates collaboration in a multilingual environment.

Conclusion

Changing the language on Brinta’s tax automation platform is a simple process that can significantly enhance the user experience for teams in Latin America and beyond. With Brinta’s multilingual support, businesses can ensure that every team member can navigate the platform comfortably in their preferred language. This customization not only improves accessibility but also underscores Brinta’s commitment to supporting diverse, multilingual teams across Latin America.